“Financial Advising is a prescriptive activity whose main objective should be to guide investors to make decisions that serve their best interests.”- Daniel Kahnemann

Executive Summary

We believe investors should seek any advice but that they will be better served in a fee-only advisory relationship where the advisors’ interests are aligned with his clients.

- Most investors simply don’t understand that their advisors may not be incentivized to work in their best interests. This is an issue we can address in detail with prospective clients.

- Investors underperform investments because they are greedy when they should be fearful and fearful when they should be greedy.

- Evidence suggests that advisors can add value by helping their clients be less emotional about investing.

- Investors seeking truly unbiased advice should consider a fee-only relationship.

Why Fee-Only Matters

T.D. Ameritrade conducted a study that shows investors are not aware of the difference between financial advisors. Specifically:

- Investors are often not aware that there are two types of (investment) advice available to investors: Registered Investment Advisors and Stockbrokers (Global View is a Registered Investment Advisor)

- 54% of investors believed both Stockbrokers and Registered Investment Advisors have a responsibility to act in their best interests

- 74% of investors did not understand the different obligations required of Resgistered Investment Advisors and Stockbrokers.

Unlike Stockbrokers, Registered Investment Advisors have a legal obligation to act in the investors’ best interest, and under no circumstance is RIA's decision-making swayed by company commissions or internal pressure to shill pre-packaged financial products. Registered Investment Advisors sole responsibility is to that of its investment clients.

We made this discovery ourselves through a long journey. We left a major Stockbrokerage firm in 2004. At the brokerage firm, we knew the pressure advisors have to “meet production,” i.e. to generate fees and commissions for their (often) publicly traded company. Initially we worked with an independent brokerage firm and under their RIA. In 2007, we formed our own RIA and severed ties with the brokerage firm. While this does not make us unique it does set us apart from those advisors who only know the brokerage side of “advice” or the advisory side of the business.

Fee only matters because investors typically believe their “advisor” provides recommendations that are in their best interest.

Unfortunately, this is not necessarily true. Louis Lowenstein, now deceased professor of Law at Columbia University, chronicled this in some detail in his book The Investor’s Dilemma, written in 2008.

He detailed a number of issues that make it hard for advised and unadvised investors to make money:

- The proven method of producing reliable returns since the 1930s is practiced by a very small minority of investors

- It is difficult for investors to make money by investing in individual securities because they are intangible, easily created, complex and difficult to analyze, trade in a secondary market, and rare buoyed by excess liquidity therefore often under or overpriced

- Most fund companies (and brokerage firms) are publicly traded. Their first duty (legally) is to make money for the parent company instead of for their clients

- Indexing and buy and hold doesn’t work because prices matter and we are human beings who react to prices

- Conflicts of interest may arise where officers of public funds own stock of the company instead of shares in the company’s funds

- Revenue sharing deals occur where brokerage firms and insurance companies are paid by investment providers and in turn give them better shelf space so they are more accessible to investors. This occurs in advised and retail (unadvised) relationships

- Large brokerage firms and insurance companies prey on investor emotions by selling greed when times are good and fear when times are bad, as evidenced by their advertising

- Picking an investment should be based on a more complex decision process than recent performance

- “Experts” consistently mislead investors often portraying things in an overly optimistic light

- The majority of mutual funds are an illustration of economies of scale in marketing but serve little purpose for investors

InvestORs underperform InvestMENTS

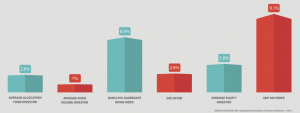

We agree with Daniel Kahneman. Dalbar studies consistently show that investors significantly underperform the investments they use because they generally buy and sell at the wrong times. In other words, they are human beings who feel comfortable with the investing herd and are not like Warren Buffet and others who run against it. They are fearful when they should be greedy and greedy when they should be fearful. This is the first and in our opinion most important reason for investors to seek an advisory relationship.

In addition to the Dalbar study, we conducted our own analysis on the largest mutual funds and found the performance of investors to be lower than the investments they purchase. This can only be attributable to their tendency to buy and sell at the wrong time.

Advised InvestORS appear to do better than Retail investORs

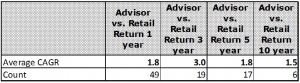

We then continued this analysis in an attempt to distinguish the performance of advised investors vs. retail investors. Again, using the largest mutual funds, we selected pairs with differing share classes and compared the institutional share (which an investor may need $1,000,000 to buy but which an advisor can buy in smaller lots) against the retail share (the share offered at low cost brokerage firms without a transaction fee). The chart above shows the performance of the advised class vs. retail class and confirms that advised investors appear to do better than retail investors.

We then continued this analysis in an attempt to distinguish the performance of advised investors vs. retail investors. Again, using the largest mutual funds, we selected pairs with differing share classes and compared the institutional share (which an investor may need $1,000,000 to buy but which an advisor can buy in smaller lots) against the retail share (the share offered at low cost brokerage firms without a transaction fee). The chart above shows the performance of the advised class vs. retail class and confirms that advised investors appear to do better than retail investors.

What Fee Only Means to You

It is our firm conviction that we can provide better service to our clients if we are paid only by our clients and are able to act solely in their financial interests. This means:

- We do not accept payment from investment providers other than incidental research

- We do not accept commissions for the sale of investment products or insurance

- We select investments because we believe they are appropriate for our client

- We will monitor the investment environment and our investments and make changes when appropriate

- We seek out the best possible sources of independent research and are not swayed by advice provided by major brokerage firms

- We will always put our clients’ interests first

Ken Moore, CFP®, MBA

Managing Partner