Our friends at Grandeur Peak, which was founded by Robert Gardiner who ran the Wasatch Microcap fund (WMICX) from 1995-2007 and returned 25% p.a. with only one down year, have credibility with us on investing. Everyone has their eye on China and may in fact be concerned that the China slowdown will bring down the global economy and stock markets with it.

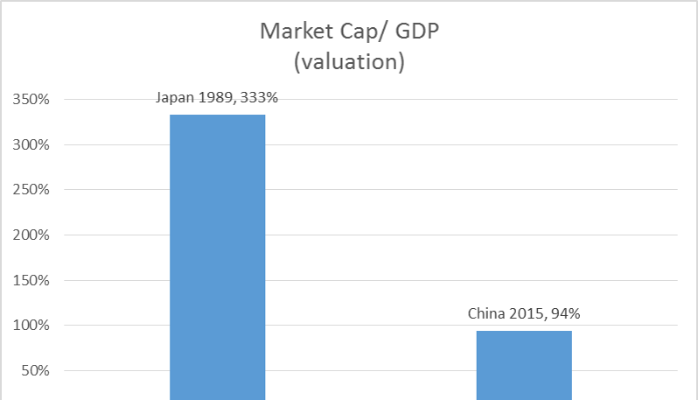

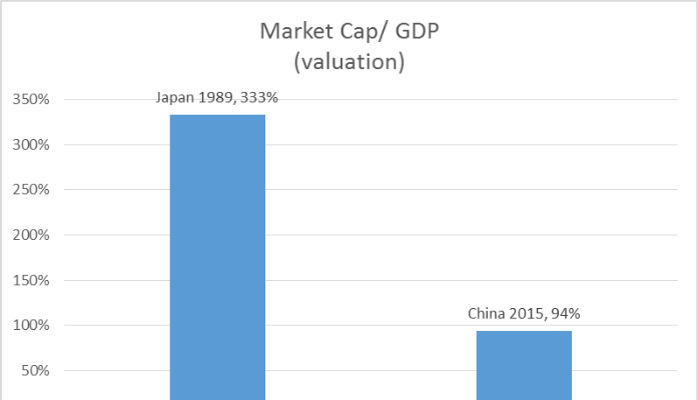

Some make the analogy to Japan in 1989. In 1989 the Japanese stock market was 38% of the total world stock market but the economy was only 9%, of world GDP i.e. the market cap/ GDP ratio was about 333%. Today, China is about 16% of the world stock market and about 17% of the world GDP, i.e. about 94%. When the Japanese stock market bubble burst in 1989 it did not take the global economy with it. Given the difference in valuations here it does not appear to be logical that China's slowdown will effect the global economy dramatically.

Click here to read the commentary from Grandeur Peak below to learn more about how they are finding opportunity in these volatile markets by visiting companies in it. Remember, excellent returns are made during difficult times.