Your Independent Advocate

Warren Buffett’s business partner Charlie Munger warned investors that a person will advise someone else to take an action that pays them best. He recommended that investors always be wary of those offering financial advice.

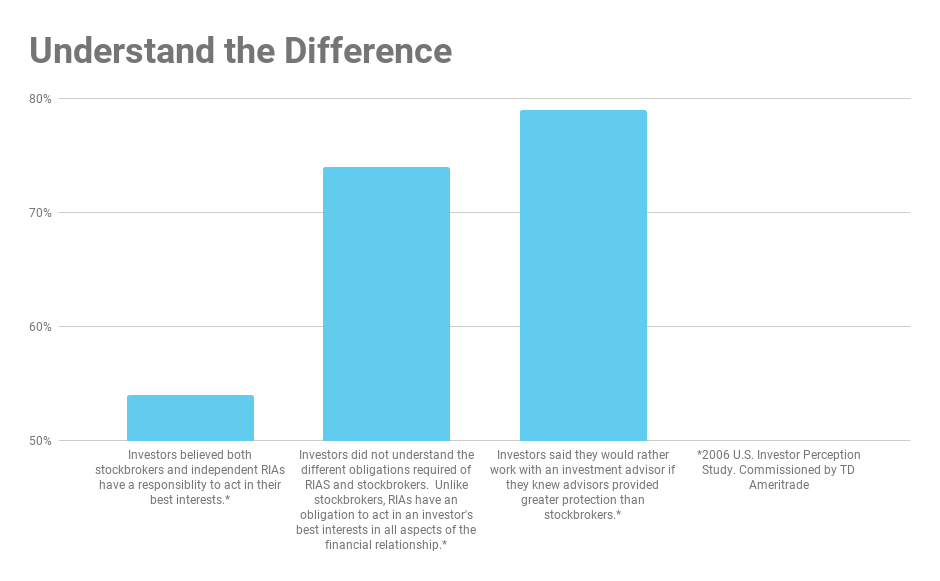

Most investors don’t understand this. Financial advisors aren’t incentivized to work in investors’ best interests. Instead they are usually incentivized to work in their employer’s best interest. Big difference.

We call this a conflict of interest.

The Fee-Only Investment Advantage

Conflicts of interest are part of the fabric of Wall Street:

- The well-known brands (like banks, wirehouses and insurance firms) force advisors to meet sales quotas. Because our advisors graduated from the Merrill Lynch training program, we know this. And it’s why we don’t have such incentives.

- Financial advisory firms profit from sharing revenue with investment managers. This means they are more likely to choose investment managers that will pay them a bigger cut. And it means these investment managers might not be the right ones for you.

- An advisor with an insurance license will often sell insurance for a simple reason: it pays a high commission. But if the high commission were not a factor, the advisor could find a far less expensive solution to your needs.

- With these well-known firms, there’s always a temptation to push you to generate more revenue. Which means to buy specific products or to buy and sell investments more often.

How can you know if you’re getting good advice, or just advice that will pad the advisor’s own pockets?

You don’t. So what’s the solution? Avoid it all together by choosing a fee-only advisor.

At Global View Investment Advisors:

- we’re 100% fee-only

- we will not try to sell you financial products

- we accept no commissions (from securities or insurance) or referral fees for choosing specific investments

- we simply make the investment recommendations that are best for you

You Need a Fiduciary

When you see a doctor, you can trust that the person you see is a qualified, licensed Medical Doctor. You know your doctor is there to try to solve your problem. You don’t worry that your doctor is selling you a product to line the hospital’s pockets. Unfortunately we can’t say this about the financial advice industry.

Anyone can call themselves a ‘financial advisor’. Many aren’t advisors at all. They ‘re just salesmen, paid commissions. The best example today is the insurance salesmen. In exchange for hollow guarantees they charge enormous commissions. And they have no legal duty to put your financial interests before their own. Instead they are simply required to sell you something “suitable” at the time of sale. With no ongoing duty to make sure your needs didn’t change.

Because there might be other choices that cost a lot less and offer you more flexibility, you need to know that. Before you sign on the dotted line.

It’s not personal. In fact, it’s likely that the “advisor’s” employer pressures him to sell the most profitable products (which could be higher cost, riskier, or just worse). He may need to do it to keep his job.

It’s a bad model and it costs Americans billions of dollars every year.

Fortunately, there’s a better way: hire a fiduciary financial advisor.

A fiduciary is someone who must put your interests first. Not only because it’s the right thing to do. But because it is legally required!

A “fiduciary” is defined as one who obligates himself or herself to act on behalf of another and assumes a duty to act in good faith and care, candor, and loyalty in fulfilling its obligations.

As an independent Registered Investment Advisor, Global View acts as your legal fiduciary. We are required to work in your best interests at all times. Unlike advisors at the Wall Street firms, we cannot put our own interests above yours.

No matter who you hire, don’t settle for less. Always demand a fiduciary!

But be aware… the fiduciary standard doesn’t cover insurance. This means you should never hire an advisor who can sell insurance (and receive insurance commissions).

Conflict-Free by Design

At Global View Investment Advisors our business is structured specifically to eliminate legal and financial conflicts of interest.

I know what you are thinking. How can we eliminate conflicts of interest when we are paid to manage other people’s money? The answer is that we can’t eliminate them completely. But we can be transparent.

We have one bias and only one. Our bias is that we believe we can do a better job for you than you would on your own. And we think it’s worth it. The good news is you get to decide. It’s all out in the open:

- We are privately owned and operated. So we have no corporate office or public shareholders to report to. Instead, our loyalty is only to you.

- Financially, our interests are aligned with yours. When we do what we say we will do we earn trust, get referrals and grow. This means you can trust that our advice is in your long-term interest. You can terminate us at any time. We must continually earn your trust. And by doing so we prosper alongside you on the journey.

- Global View goes a step further: we literally invest alongside you. We invest in the same strategies that we prescribe for you. We believe in our investment strategies, and we put our money where our mouth is.

We want to put ourselves in your shoes. Unless you worked as a financial advisor for a big firm there is no way for you to know what we know. Because our advisors worked for one (Merrill Lynch), we know the pressure put on advisors. Quarterly sales quotas, production targets, mortgage targets, etc. are all par for the course. Advisors at these firms don’t even know what they don’t know. But you can see the problem simply by watching the news. Remember the latest scandal?

We left Merrill Lynch because we wanted no part of that.

We founded Global View because we know investors need an advocate. Only by being your advocate does our advice mean anything. Only then is it real. We want to give you real advice. By making sure you avoid common mistakes we help you to achieve your financial goals. Learn more about our story here.

With Global View Investment Advisors, you can trust that you will receive real advice from a team whose interests are aligned with yours.

We wouldn’t have it any other way.