Navigating Social Security

Social Security is a part of nearly every American’s retirement plan. Even high net worth individuals, who may get the bulk of their retirement income from their own savings and investments, generally still benefit from the guaranteed monthly income Social Security provides.

Social Security is a part of nearly every American’s retirement plan. Even high net worth individuals, who may get the bulk of their retirement income from their own savings and investments, generally still benefit from the guaranteed monthly income Social Security provides.

However, Social Security is not meant to be a retiree’s sole source of income in retirement. The Social Security Administration (SSA) aims to replace only about 28 percent of high earners’ pre-retirement income. That said, with the right planning, you can stretch your Social Security benefits to get the maximum amount you qualify for.

At Global View, we have two Registered Social Security Analysts with the National Association of Registered Social Security Analysts on staff, who are ready to help you make an informed decision about these important benefits. We’ve put together this guide, which takes a look at what high net worth retirees in North and South Carolina should know about navigating Social Security. If you have questions that aren’t addressed here or would like to discuss your specific situation in more detail, let’s talk!

Eligibility

To qualify for Social Security benefits, you must have earned enough work credits to be what the SSA calls “insured.” Work credits are earned as you work and pay Social Security taxes. In 2021, workers earn one credit for every $1,470 they make in earnings, up to a maximum of four work credits per year.

To be eligible for Social Security retirement benefits, you generally need 40 work credits (the equivalent of 10 working years) or have a spouse or ex-spouse who did. If you’re qualifying based on a spouse or ex-spouse’s work record, you don’t need any work credits of your own. You do, however, need to be currently married or have been married to your ex-spouse for at least 10 years before getting a divorce. Widows and widowers can qualify off of their deceased spouse’s record as long as they’re age 60 or older, regardless of how long the marriage lasted.

While individuals who meet the above qualifications can begin collecting Social Security as early as age 62 (or age 60 for surviving spouses), it may be wise to wait to start collecting Social Security until you at least reach your full retirement age.

Read our blog post:

Retirement Planning in the Carolinas: 5 Myths About Social Security

Full Retirement Age

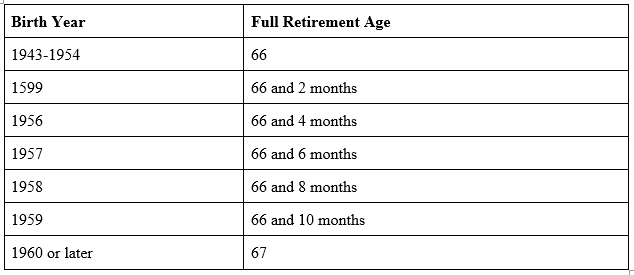

Your full retirement age is the age at which you qualify for your full retirement benefit. Your full retirement age varies based on the year you were born. In 2021, individuals born in 1954 or earlier have already reached their full retirement age. The following table shows the full retirement age based on your year of birth:

Read our blog post:

Taking Benefits Before Your Full Retirement Age

If you begin taking Social Security benefits before your full retirement age, your benefit amount will be reduced by approximately 0.5 percent for each month you receive benefits before reaching your full retirement age. For example, if your full retirement age is 66 and you start taking benefits at age 62, you’d only receive about 76 percent of your full benefit amount.

For this reason, it can make sense to wait until you at least reach your full retirement before claiming Social Security. If you don’t need the money early but start taking benefits early, it’s the equivalent of leaving money on the table. The exception to this is if delaying your Social Security benefits would require you to use more of your own investments and savings than planned. Withdrawing too much from your portfolio in the early years of retirement can handicap your growth potential later on and cause you to risk running out of money in retirement. In such cases, it may be best to start Social Security benefits earlier, even if it means receiving a smaller overall benefit amount.

Talk to a financial advisor before making a decision about your Social Security benefits, because the decision is permanent!

Read our blog posts:

3 Reasons You May Want to Claim Social Security Benefits Early

Financial Advisor Warns: 5 Retirement Decisions You Can’t Go Back and Change

Taking Benefits After Your Full Retirement Age

Once you reach your full retirement age, you qualify for 100 percent of your Social Security benefits. But if you continue to wait to take your benefits until later, the amount you receive will be even higher.

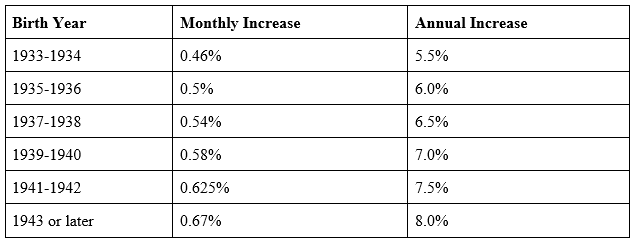

The SSA will increase your retirement benefit for each year you delay taking your Social Security benefits after full retirement age until you turn age 70. The amount of the monthly increase depends on the year you were born, as shown in the following table:

Once you reach age 70, your benefit amount will stop increasing. Again, talk to a financial advisor before making a decision about your Social Security benefits, because the decision is permanent!

Read our blog posts:

3 Reasons You May Want to Claim Social Security Benefits Later

Spousal and Survivor Benefits

As mentioned above, spouses who never worked or had low earnings may be able to qualify for a spousal retirement benefit that’s up to half of the retired worker’s full benefit. The SSA now uses what’s called “deemed filing.” This means that if you’re born on or after January 2, 1954 and apply for either a spousal or your own Social Security benefits, you’re “deemed” to also be applying for the other. The SSA will pay you the higher of either your or your spousal benefit, if you qualify for both.

Current, former and surviving spouses can also qualify for Social Security benefits off of their (former) spouse’s work record. To qualify for a benefit based on an ex-spouse’s record, you must have been married to your ex for at least 10 years before getting divorced, be age 62 or older, and not be currently married yourself. As with your own benefit, if you take your spousal benefit before reaching your full retirement age, you’ll receive a reduced amount.

Qualifying ex-spouses can start receiving a spousal benefit even if their ex-spouse hasn’t applied for their own retirement benefits yet. Current spouses, on the other hand, must wait until their spouse begins receiving benefits to claim a spousal benefit, unless the non-working spouse is caring for a minor or disabled child who is also entitled to benefits based on the working spouse’s record.

Surviving spouses can begin receiving a widow’s or widower’s benefit as early as age 60, or age 50 if disabled. Surviving spouses have the additional option of taking a reduced early benefit based on their deceased spouse’s record, then switching to their own benefit later. This can be a useful planning strategy, allowing you to claim benefits early without reducing your own benefit amount. For instance, a widower may begin taking a reduced widower’s benefit at age 60 then switch to his own benefit at his full retirement age.

Read our blog post:

Social Security and the Pandemic

Social Security Strategies for Married Couples

Social Security and Divorce – What Many People Don’t Know

Estate Planning Greenville, SC: 5 Financial Planning Tips for Widows/ Widowers

Medicare

Like Social Security, you’ve likely been paying into the Medicare health insurance system for your entire working career. Medicare is the basic health insurance program for Americans age 65 and older. It’s not the same as Medicaid, which is a healthcare program for low income individuals.

There is a lot of confusion when it comes to Medicare, so here’s a brief overview from the Certified Financial Planners (CFPs) at Global View:

If you qualify for Social Security, you are automatically eligible for Original Medicare, which includes Parts A and B. Medicare Part A is hospital insurance that helps cover the cost of inpatient stays or limited time at a skilled nursing facility, as well as some home and hospice care. Part B is medical insurance, which helps cover the costs of visits to a doctor or other healthcare providers’ office.

You can get additional coverage through Medicare Part C, known as Medicare Advantage Plans, which provides the same coverage as Original Medicare but with additional benefits, such as vision, hearing and dental, available on a per-plan basis. You can also choose to get Medicare Part D, which is prescription drug coverage.

Most people qualify for free Medicare Part A, but the other parts of Medicare may require you to pay a premium. As such, Parts B, C and D are all optional.

If you start receiving your Social Security benefits before age 65, you’ll be automatically enrolled in Parts A and B when you become eligible. If you delay taking your Social Security benefits, you’ll need to enroll in Medicare yourself.

Regardless of when you reach your full retirement age, it’s wise to apply for Medicare three months before your 65th birthday. If you wait longer than this to apply, you may incur a penalty for Medicare Part B and Part D that will be added to your premiums for the rest of your life.

Read our blog post:

Retirement Planning Greenville, SC: Understanding Medicare’s Role